Defuse the bomb: Rewiring Interbank Networks

Chinazzi, M., Pegoraro, S., & Fagiolo, G. (2015). LEM Papers Series, 2015/16 https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2616218

Abstract

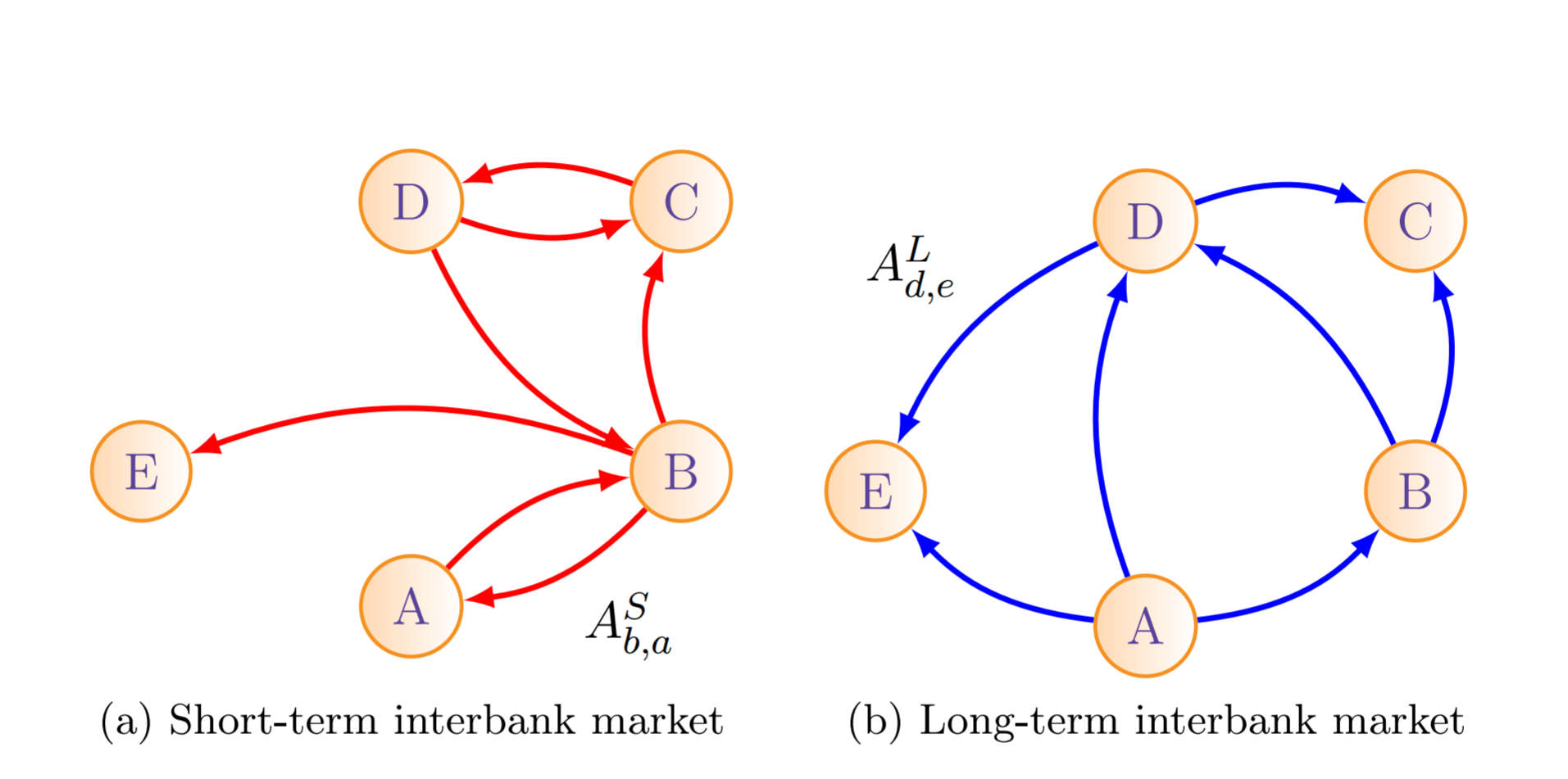

In this paper we contribute to the debate on macro-prudential regulation by assessing which structure of the financial system is more resilient to exogenous shocks, and which conditions, in terms of balance sheet compositions, capital requirements and asset prices, guarantee the higher degree of stability. We use techniques drawn from the theory of complex networks to show how contagion can propagate under different scenarios when the topology of the financial system, the characteristics of the financial institutions, and the regulations on capital are let vary. First, we benchmark our results using a simple model of contagion as the one that has been popularized by Gai and Kapadia (2010). Then, we provide a richer model in which both short- and long-term interbank markets exist. By doing so, we study how liquidity shocks (de)stabilize the system under different market conditions. Our results demonstrate how connectivity, the topology of the markets and the characteristics of the financial institutions interact in determining the stability of the system.

Recommended citation: Chinazzi, M., Pegoraro, S., & Fagiolo, G. (2015). "Defuse the bomb: Rewiring interbank networks". LEM Papers Series, 2015/16.